Tax Planning vs. Tax Preparation

Twenty-First-Century Retirement

Social Security Misconceptions

Inflation

Building Your Financial House

Dependable Income

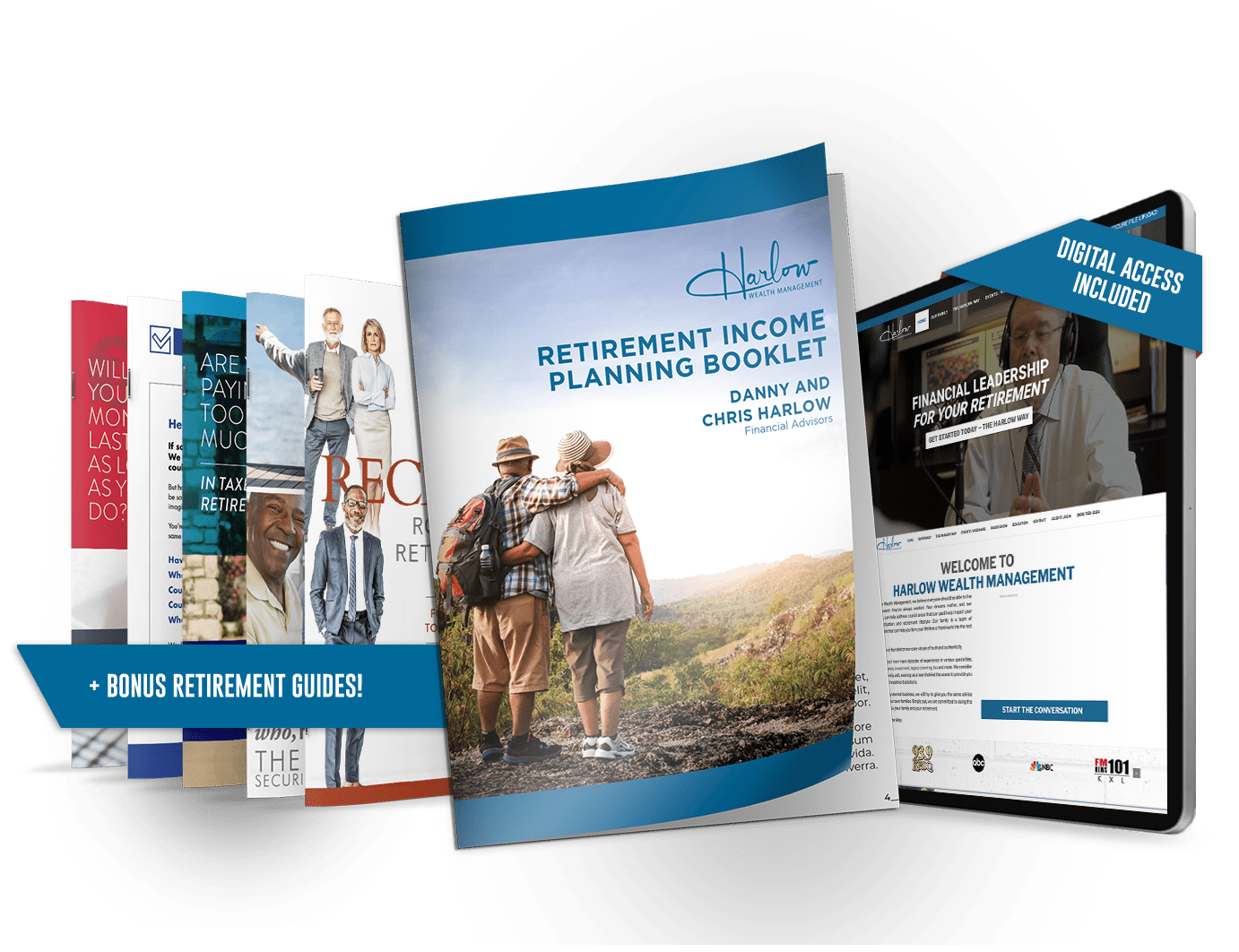

The Complimentary Toolkit You Should Consider for Retirement

- Ways to transform your worries about retirement into confidence

- Ways to discover the weak points in your retirement plan

- Ways even small tweaks to your retirement plan can make a difference

Retirement Insights

Retirement Insights is a weekly segment that airs on KGW channel 8 (NBC) featuring Danny Harlow and Chris Harlow of Harlow Wealth Management. Each week an informative financial retirement topic is discussed. Catch-up on all of the segments below and make sure to download our complimentary retirement toolkit.

Estate Planning

Estate planning can be foundational to your overall retirement plan. According to Danny Harlow, having wills, trusts, powers of attorney and health care directives set up can be helpful to your loved ones. Join Danny Harlow for this informative episode.

Is a Roth Right for You?

Income tax rates are set to go up in 2026. Knowing this can be helpful for considering a Roth IRA strategy. Learn whether a Roth is right for you during this segment with Danny and Chris.

Fees

Fees can sometimes eat away at you nest egg. Potentially reducing your fees may be a good way to strategize your retirement. Join Chris Harlow for this exciting segment.

Importance of a Comprehensive Plan

A comprehensive plan can help retirees have more confidence in their golden years. Join Danny Harlow for this informative episode.

Long-Term Care

According to LongTermCare.gov, someone turning 65 today has almost a 70% chance of needing some type of long-term care in their remaining years. So, you’ll want to make a retirement plan accordingly. In this episode Danny and Chris Harlow talk about planning for the cost of long-term care.

Unexpected Early Retirement

Sometimes retirement comes unexpectedly. In these situations, it is advised that you stay calm and work with a trusted advisor to design a financial plan for your unique needs. Join Chris Harlow for this valuable segment.

Retirement Risks

From higher taxes and longer life expectancy to added health care costs and economic downturns — there are many types of potential retirement risks out there. In this episode, Danny Harlow talks about how to avoid risk in your retirement.

Surviving Volatility

Chris talks about the different ways to deal with volatility which is especially important when you are thinking about your retirement savings.

Number-One Fear

One of the biggest fears of retirees is outliving their retirement savings. In this episode, Chris Harlow emphasizes why retirement planning may be important to avoiding unforeseen landmines like inflation, health care costs and taxes.

- « Previous

- 1

- 2

- 3

- 4

- Next »

TV shows are paid placements and are intended for informational purposes only. It is not in-tended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. As of Oct 31, 2024, insurance products are being offered through Harlow Insurance Agency, LLC, an agency registered in Washington and other states as required and an affiliate of Harlow Wealth Management, Inc. Materials posted prior to this date include the Firm’s previous disclosure. Any questions pertaining this should be sent to ask@harlowwealth.com