Tax Planning vs. Tax Preparation

Twenty-First-Century Retirement

Social Security Misconceptions

Inflation

Building Your Financial House

Dependable Income

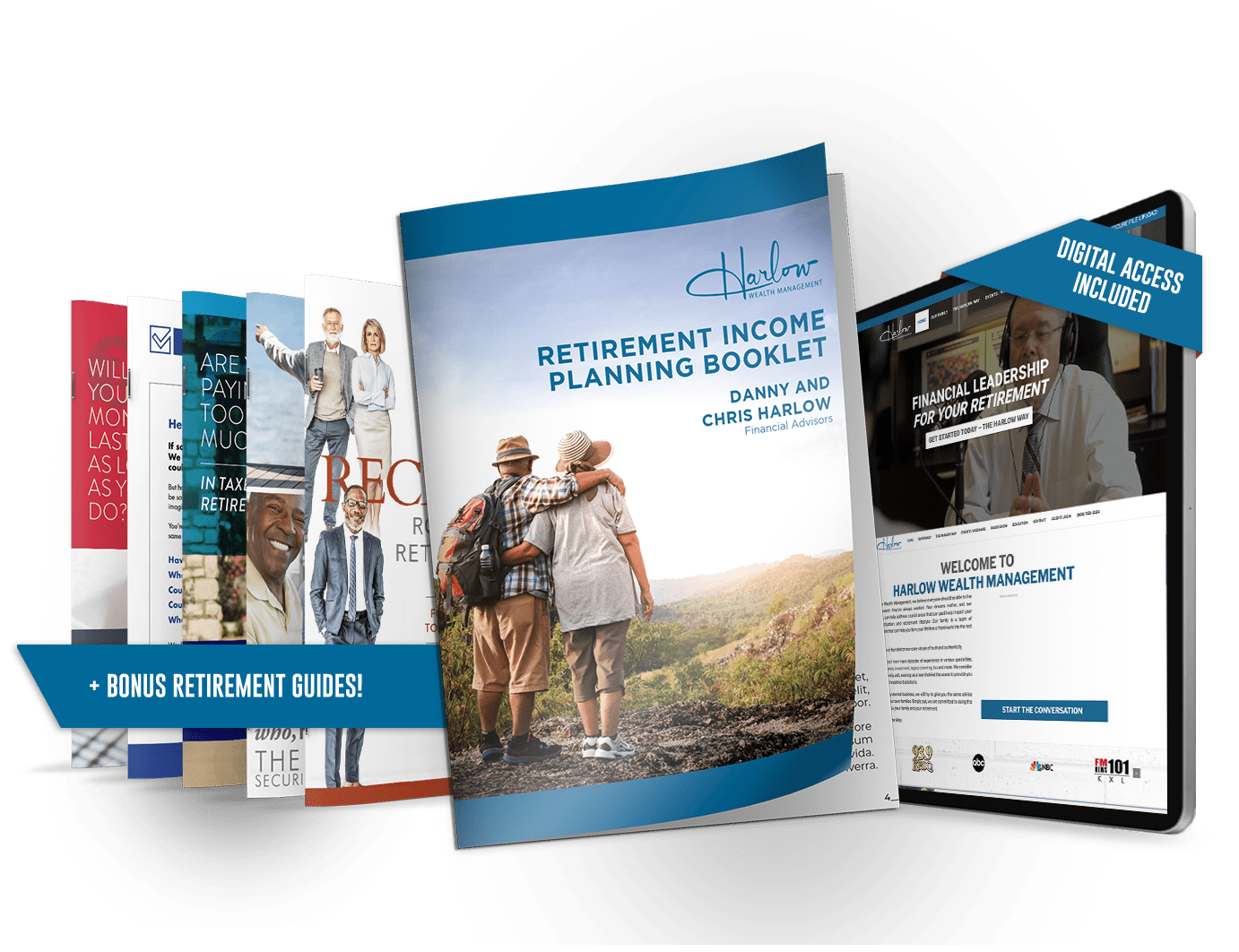

The Complimentary Toolkit You Should Consider for Retirement

- Ways to transform your worries about retirement into confidence

- Ways to discover the weak points in your retirement plan

- Ways even small tweaks to your retirement plan can make a difference

Retirement Insights

Retirement Insights is a weekly segment that airs on KGW channel 8 (NBC) featuring Danny Harlow and Chris Harlow of Harlow Wealth Management. Each week an informative financial retirement topic is discussed. Catch-up on all of the segments below and make sure to download our complimentary retirement toolkit.

Income Planning

Having a written income plan on how to get through retirement is a great first step to making sure you have sufficient income to last throughout retirement. Join this special segment with Danny Harlow and learn about income planning.

Life Insurance

Does a life insurance policy make sense in retirement? Chris and Danny tackle this important topic in this segment.

401(k) Rollover

On this episode, Chris Harlow, CEO of Harlow Wealth Management, discusses the different rollover options available to people nearing or in retirement.

Optimizing Social Security

Danny Harlow, founder of Harlow Wealth Management, discusses the difference between maximizing Social Security and optimizing it. Learn more in this episode about why it may come down to timing.

Three Stages of Retirement

Retirement is not the finish line, but the starting line. In this episode Danny and Chris Harlow discuss the Go-Go, Go-Slow and No-Go stages of retirement.

Are Taxes Rising Soon?

Taxes are a big topic right now. That’s because they are historically low. In 2026 taxes are set to go up. Because taxes can change, having a tax plan is one of the tools you should consider having in your retirement toolkit. Watch the full segment with Chris Harlow.

Protected Income

How can we make sure that income in retirement will last through the entirety of retirement? In this segment Danny discusses some tools and options available to retirees to help them navigate this question.

Health Care

Health care alone could cost the average couple retiring today an estimated $300,000 (Source: Fidelity). Learn more about planning for health care expenses in retirement with Danny and Chris Harlow.

Diversification

Diversification is the strategy of spreading out your money into different types of investments, which can reduce risk. Learn why this approach is one that you may want to look at for your retirement. Join Chris Harlow for this special episode.

- « Previous

- 1

- 2

- 3

- 4

- Next »

TV shows are paid placements and are intended for informational purposes only. It is not in-tended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. As of Oct 31, 2024, insurance products are being offered through Harlow Insurance Agency, LLC, an agency registered in Washington and other states as required and an affiliate of Harlow Wealth Management, Inc. Materials posted prior to this date include the Firm’s previous disclosure. Any questions pertaining this should be sent to ask@harlowwealth.com