Tax Planning vs. Tax Preparation

Twenty-First-Century Retirement

Social Security Misconceptions

Inflation

Building Your Financial House

Dependable Income

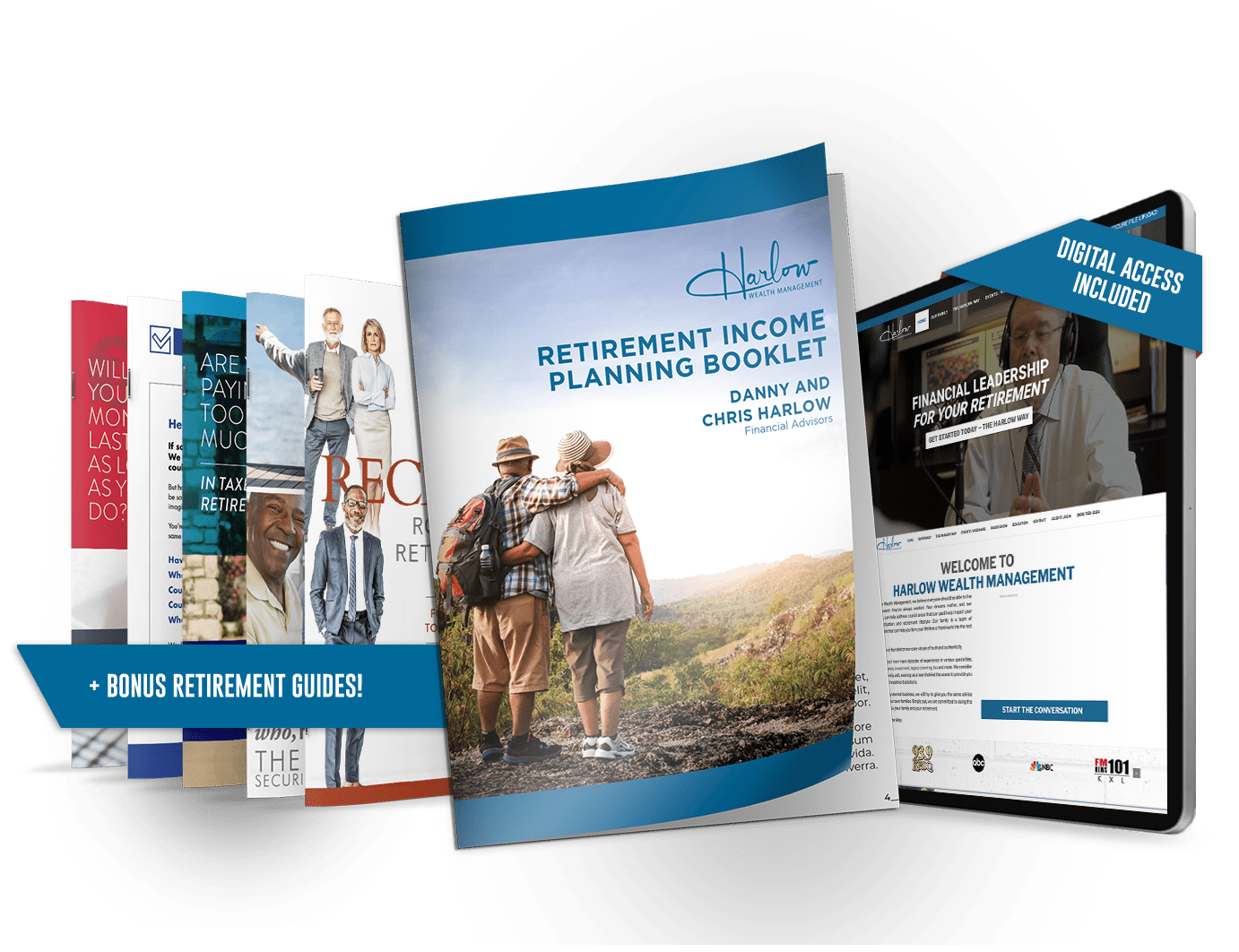

The Complimentary Toolkit You Should Consider for Retirement

- Ways to transform your worries about retirement into confidence

- Ways to discover the weak points in your retirement plan

- Ways even small tweaks to your retirement plan can make a difference

Retirement Insights

Retirement Insights is a weekly segment that airs on KGW channel 8 (NBC) featuring Danny Harlow and Chris Harlow of Harlow Wealth Management. Each week an informative financial retirement topic is discussed. Catch-up on all of the segments below and make sure to download our complimentary retirement toolkit.

Tax Planning vs. Tax Preparation

Danny Harlow distinguishes between tax planning, which is a forward-thinking strategy, and tax preparation, which tends to look at only the past tax year. Join Danny for this informative segment.

Twenty-First-Century Retirement

Today’s retirement just doesn’t look the same as it did for our parents and our grandparents. Learn how the next generation of retirees face unique challenges including fewer pension plans, inflation, possible higher taxes, longer life expectancies and more.

Social Security Misconceptions

Social Security can be foundational to your retirement. However, there are misconceptions out there when it comes to Social Security, including when to take it and the tax ramifications. Join Chris for this informative episode.

Inflation

Inflation is a serious concern for a lot of retirees. In this episode Danny talks about today’s inflation and the balance that people need to have between the safety and growth of their money.

Building Your Financial House

You’ve probably thought a lot about your dream retirement, but you might not know how to make it happen. Danny Harlow talks about how building your retirement is a lot like building a house.

Dependable Income

Dependable income is important when you get to retirement, especially in the absence of pensions, which many people no longer have. Developing and designing retirement income that is reliable and predictable is key to enjoying your retirement. Make sure to join Chris Harlow for this educational segment on dependable income.

Required Minimum Distribution

Most of us have money set aside for retirement in a 401(k), but there are taxes involved. It is important to understand the timing involved in required minimum distributions and how to plan for taking them. Learn more about this important piece of the retirement puzzle by tuning into this segment with Danny Harlow.

Navigating Uncertainty

Retirement doesn’t have to be unpredictable. With the aid of a retirement income plan you can know your income options as well as the risks each one poses. Join Danny and Chris Harlow for this educational episode.

Rainy-Day Funds

There are sometimes storms in life. That’s why it is important to have money set aside for those rainy days. How much you set aside and how much should be liquid are just some of the topics discussed in this episode with Chris Harlow.

TV shows are paid placements and are intended for informational purposes only. It is not in-tended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. As of Oct 31, 2024, insurance products are being offered through Harlow Insurance Agency, LLC, an agency registered in Washington and other states as required and an affiliate of Harlow Wealth Management, Inc. Materials posted prior to this date include the Firm’s previous disclosure. Any questions pertaining this should be sent to ask@harlowwealth.com