Welcome To

HARLOW WEALTH MANAGEMENT

At Harlow Wealth Management, we believe everyone should be able to live the retirement they’ve always wanted. Your dreams matter, and our strategies can help address crucial areas that can positively impact your financial situation and retirement lifestyle. Our family is a team of professionals that can help you turn your lifetime of hard work into the rest of your life.

Our business is founded on our core values of truth and authenticity.

Members of our team have decades of experience in various specialties, such as insurance, investment, legacy planning, tax and more. We consider ourselves a family unit, working as a team behind the scene to provide you with informed investment solutions.

And, as a family-owned business, we will try to give you the same advice we would give our own families. Simply put, we are committed to doing the right thing for you, your family and your retirement.

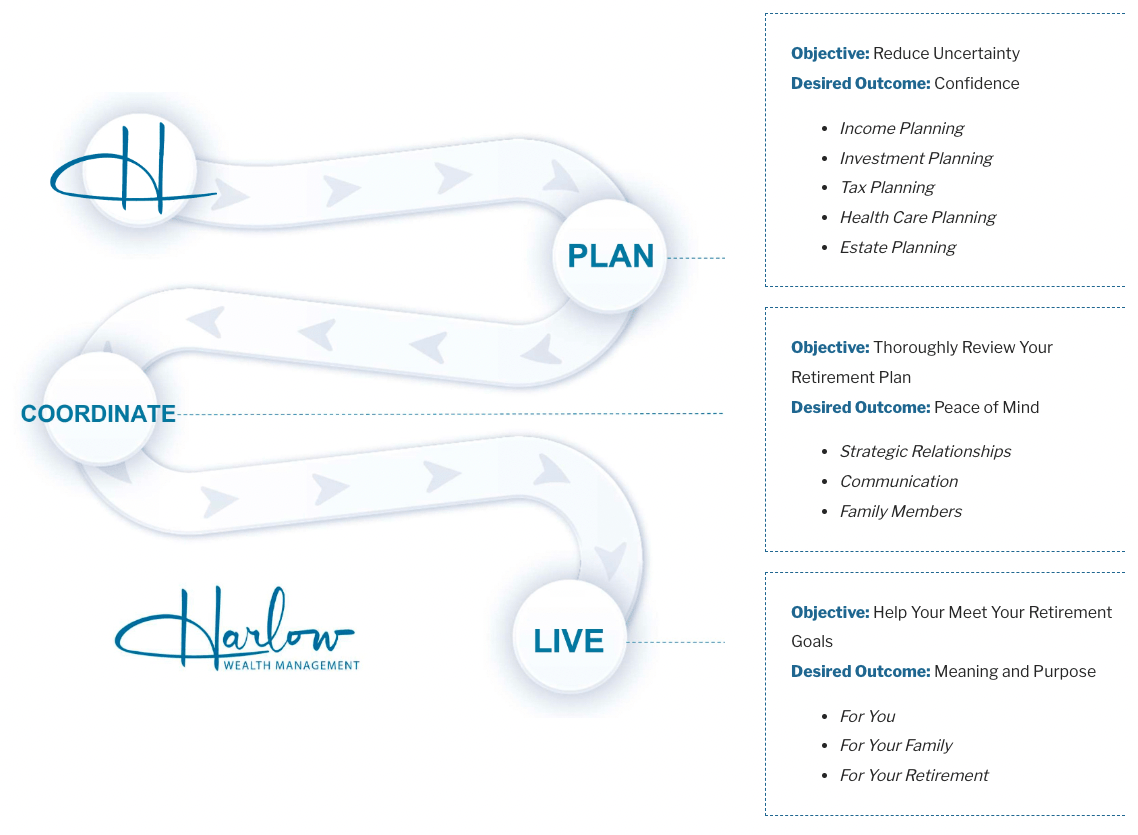

The Harlow Way TM

Desired Outcome: Confidence

- Income Planning

- Investment Planning

- Tax Planning

- Health Care Planning

- Estate Planning

Desired Outcome: Peace of Mind

- Strategic Relationships

- Communication

- Family Members

Desired Outcome: Meaning and Purpose

- For You

- For Your Family

- For Your Retirement

BUILDING LIFELONG RELATIONSHIPS IS WHAT WE DO.

HARLOW WEALTH

CHECKLIST CHALLENGE

At Harlow Wealth Management, we take pride in helping create a winning retirement. Our Checklist Challenge features some of the most important areas to address when planning your retirement future. Taking the Checklist challenge can help you get on the road to creating your best retirement.